A colossal shift in wealth is poised to sweep the globe, and Japan is no exception.

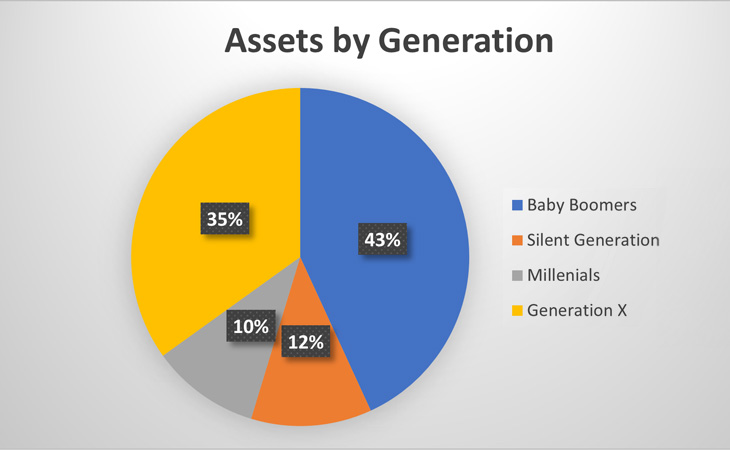

Like the rest of the world, the time is nearing when baby boomers, renowned for their substantial wealth, will pass on the torch to the younger generation.

This financial transformation, often dubbed “The Great Wealth Transfer,” holds worldwide significance and carries specific implications for expats in Japan.

Understanding what this wealth transfer entails and why seeking the guidance of a financial advisor is crucial.

Millennials on the Brink of a Generational Windfall Thanks to Baby Boomer Parents

As Baby Boomers savor the retirement phase of their lives, they’re now pondering how to pass on their hard-earned wealth to their offspring.

The amount of wealth about to be transferred is huge: approximately $68 trillion. This massive wealth transfer is poised to transform Millennials into the wealthiest generation ever.

Financially speaking, the transfer is timely for the younger generations, considering the hurdles Millennials face, from economic downturns and sky-high tuition fees to the seemingly elusive dream of affordable housing.

While Millennials can expect substantial inheritances, many Baby Boomers plan to bestow less than anticipated. Surprisingly, more than half of Millennials are banking on around $350,000, yet 55% of Baby Boomers aim to leave behind less than $250,000.

Various factors, including Baby Boomers’ job security and aspirations for career progression, may influence their decision to extend their working years to bolster their financial coffers. Rising healthcare expenses and longer life expectancies may significantly trim the available inheritance.

This generational wealth transfer will unleash seismic waves throughout the economy. By the 2030s, Millennials are projected to hold a whopping five times their current wealth, potentially igniting a spending frenzy, boosting investments, and propelling economic growth. The stock market may soar with more money flooding into investments.

Moreover, wealth transfer could make homeownership possible for Millennials who have grappled with exorbitant housing costs. This surge in homeownership could kickstart a cycle of economic growth through property upkeep and interior design. Inevitably, increased demand for housing could even lead to a rise in housing prices.

Let Us Help You Grow Your Wealth

Talk with us today!

The Great Wealth Transfer in Japan

The Great Wealth Transfer will also occur in Japan over the next decade. According to a 2020 article by economist Jesper Koll in the Japan Times, a massive amount of household savings, totaling around ¥1,800 trillion (about $5 trillion), will be transferred to younger generations.

The amount of wealth transfer is equivalent to Japan’s annual GDP and has the potential to boost household income by 15% each year for the next decade, essentially increasing the national GDP by about 10% annually.

This wealth transfer is unlike anything seen before in economic history, and demographics and the passing of the baby boomer generation drive it. Japan’s declining population is freeing up this substantial inheritance fund, which positions Japan uniquely in the global economic landscape.

This generational wealth transfer is not typically considered in economic models, but it’s poised to be a powerful force for positive growth and could significantly shape Japan’s future prosperity.

Navigating the Great Wealth Transfer while in Japan as an Expat

This impending wealth transfer offers opportunities and challenges for expatriates residing in Japan. As inheritors of significant assets from the baby boomer generation, expats gain access to substantial capital, paving the way for many possibilities.

Whether fostering entrepreneurship, diving into the financial markets and real estate, modernizing family enterprises, reshaping philanthropic endeavours, or driving innovation across various industries within Japan, the world is their oyster.

However, with great wealth comes great responsibility, and beneficiaries of inheritance in Japan can find themselves grappling with several challenges.

Here are the five primary hurdles they often encounter, along with some Japan-specific considerations:

-

- Estate and Inheritance Taxes: Japan has one of the highest inheritance tax regimes in the world. Tax rates can be hefty, especially for substantial inheritances, leaving beneficiaries scratching their heads about navigating and managing these tax implications, which can considerably diminish the inheritance’s value. For more information on inheritance taxes in Japan, please read our article on this topic.

- Responsible and Effective Wealth Management: Managing wealth inherited rather than earned can be daunting. Beneficiaries may struggle to handle a sudden windfall, particularly if they lack experience managing significant financial assets. A recent survey found that only about half of those expecting to receive an inheritance are very comfortable financially managing their new wealth. Investment decisions, avoiding financial mishaps, and ensuring the wealth endures for future generations become paramount concerns, especially when the beneficiary lacks knowledge or experience in wealth management.

- Managing US-Based Assets and Accounts: Inheriting assets or accounts in the United States can add an extra layer of complexity. Beneficiaries might grapple with comprehending US tax regulations, estate planning laws, and financial reporting requirements. Properly handling and maintaining accounts in the US while adhering to legal and tax obligations can pose significant challenges for beneficiaries with international ties to Japan.

- Complex Legal Procedures: Similar to many countries, Japan has its own legal procedures for transferring inherited assets. Beneficiaries may find themselves embroiled in probate processes and navigating the intricacies of the Japanese legal system, a time-consuming endeavour that often demands legal expertise.

- Real Estate Inheritance: In Japan, real estate frequently constitutes a significant part of many inheritances. Dealing with inherited property, whether it involves keeping, selling, or managing it, can be especially challenging due to Japan’s unique real estate market dynamics, regulations, and property management considerations.

To overcome these challenges, beneficiaries in Japan should seek counsel from professionals such as financial advisors and tax accountants who specialize in inheritance matters. Open and transparent communication with family members is essential for navigating cultural and familial expectations.

Developing a comprehensive financial plan that considers tax implications and long-term objectives is also crucial to ensure that the inheritance benefits the recipients to the fullest extent possible.

Are you feeling overwhelmed by the prospect of inheritance tax planning while in Japan? Feel free to contact Argentum for a complimentary initial consultation. We specialize in assisting clients in safeguarding and expanding their wealth through financial planning and tailored solutions.

Whether you’re a US national needing assistance with transferring and managing US-based accounts or require guidance through the labyrinth of Japanese inheritance processes, our expert team is here to guide you.

Argentum Wealth does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Argentum Wealth Management is licensed through the Japanese Financial Services Authority to give financial advice. The FSA strongly recommends that you only receive financial advice and services from a locally licensed and regulated firm.