The Power of Compound Interest: How to Reach Your First 100 Million JPY

Written by: David Rubenstein

Compound interest is one of the most powerful tools at your disposal to help you achieve your financial goals and counteract the effects of inflation on your money.

Whether you’re looking to build a nest egg for retirement, save for a down payment on a house, or simply grow your wealth, understanding the power of compound interest is essential. This article will explain compound interest, how it works, and why starting early is the best strategy.

What Is Compound Interest and How Does It Work?

Compound interest is the interest earned on the initial principal and the accumulated interest from previous periods. In simpler terms, it’s interest on interest.

This cycle repeats over time, resulting in significant growth of your initial investment.

The most important point is that compound interest is not linear; the growth accelerates over time, meaning the longer the money is invested and compounded, the greater the benefit.

Let’s look at some examples of investment compound growth at work.

How to Reach Your First ¥100,000,000 in Savings

Achieving this much in savings can seem daunting, if not impossible, especially when you’re just starting out. However, with the power of compound interest and enough time and perseverance, reaching your first ¥100,000,000 in savings is easier than you think.

Reaching ¥100,000,000 yen in savings will be difficult without investing over time. To achieve this sum over a 30-year period, assuming your money is left in a Japanese bank earning 0% interest would require you to save ¥270,000 every single month for 30 years straight. While not an impossible task, it is certainly not very efficient. What’s more, you will be left to do all the heavy lifting by yourself while your money sits in the bank, not working for you or earning you any interest.

Instead, let’s look at two scenarios where rather than just saving the money in cash, you put it to work through investments so that you can benefit from compound interest.

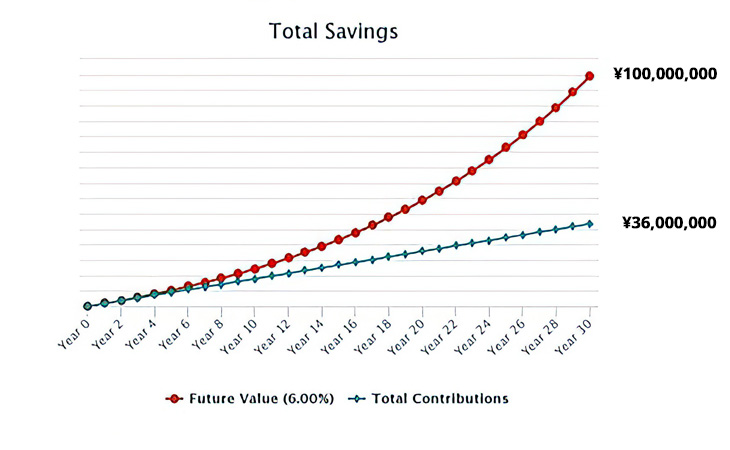

Scenario One

Monthly Investing Only ¥100,000 per month for 30 years / Total amount invested 36M JPY

Let’s say you start from scratch, investing ¥100,000 monthly for your longer-term goals, such as financial freedom/retirement.

Assuming that you start at age 30 and continue for 30 years with a compound growth of just 6% per year, by the time you are 60, you will have just over ¥100 million in your nest egg, having invested just ¥36 million over that entire time. The other ¥64 million would have been created by compound interest.

Impressive, isn’t it?

One thing to remember regarding monthly investments is that you need to be patient. The nature of the cost-averaging strategy dictates that it will take time for the compounding to really start showing its full potential.

In the early years, the growth does not seem to happen fast enough, but this is simply because there is not much money in the investment to compound, and by constantly adding more money to the account, you are averaging down the gains.

However, once the investment gains momentum, the growth will accelerate over time. You can see this effect at work in the above graph.

To illustrate how investing more money at the beginning increases the compounding effect, let’s make a simple change to the example above.

Let Us Help You Grow Your Wealth

Talk with us today!

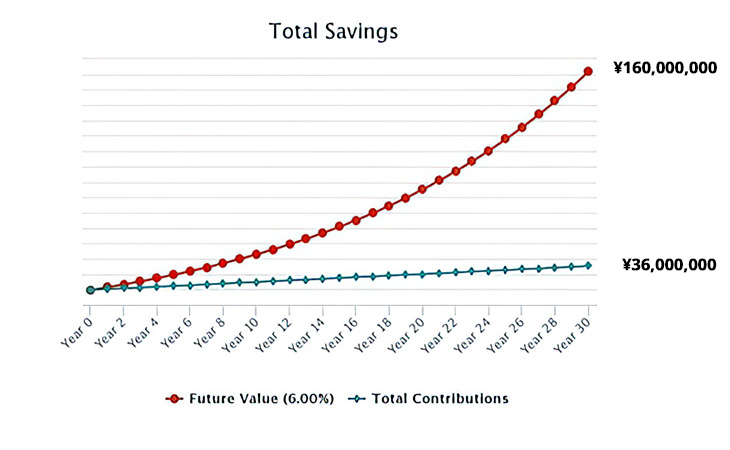

Scenario Two

Initial Lump Sum of ¥20M on Day One & Monthly Investing ¥44,000 per month for 30 years / Total amount invested ¥36M

If instead of investing every month only, you kick start your investing by placing ¥20 million into the markets and then supplementing that initial investment with a monthly strategy of just ¥44,000 per month, again over 30 years at an annual growth rate of 6% per year, by year 30 you will have achieved a nest egg of just over ¥160 million .

Compared to scenario one, over the same time period and by investing the same amount (¥36 million), you will have achieved an additional ¥60 million on top of your 100 million JPY. Moreover, compound interest would have created ¥124 million over your invested principal.

You can use the following online investment compound interest calculator to try different scenarios and better understand what is possible when you give your money enough time to work for you.

The Best Strategy: Start Early

Whether you invest toward your future goals on a monthly or lump sum basis, the most important factor determining how much compound benefit you will receive is time.

The longer you allow your money to work for you, the greater the compound benefit.

While it’s never too late to start investing toward your goals, starting early at an amount you can afford is always best. And, of course, starting late is better than not starting at all.

Conclusion

Compound interest is a powerful tool to help you achieve your financial goals. By understanding how it works and starting early, you can use the exponential growth of reinvesting your interest earnings.

Whether you want to save for retirement, pay down debt, or build wealth, compound interest is your best friend.

Ready to Start Investing in Japan?

If you’re an expat living in Japan and looking to start working towards your financial goals, Argentum can help. We offer advice on a wide range of investment options and personalized financial advice tailored to the international community.

Contact us today for a free consultation and start your journey toward financial freedom.

Argentum Wealth does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Argentum Wealth Management is licensed through the Japanese Financial Services Authority to give financial advice. The FSA strongly recommends that you only receive financial advice and services from a locally licensed and regulated firm.