When markets are volatile, people often hesitate to put their money to work because they feel they should wait for “the right time,” hoping to hit the bottom of the market. Others who are already invested may believe they can “time the markets” by selling their investments at their peak and buying back at the bottom.

However, the reality is that timing the markets is not a strategy that works consistently. Most investors are better off not trying to time markets at all; instead, they try to stay invested for as long as possible. In other words, they use “time in the market” to their advantage.

For longer-term financial goals, such as retirement and kids’ education planning, time in the market is a better strategy than trying to time the market. While this is widely known, many may not understand all the reasons why that is.

Let us look at six reasons why “time in the market” works well:

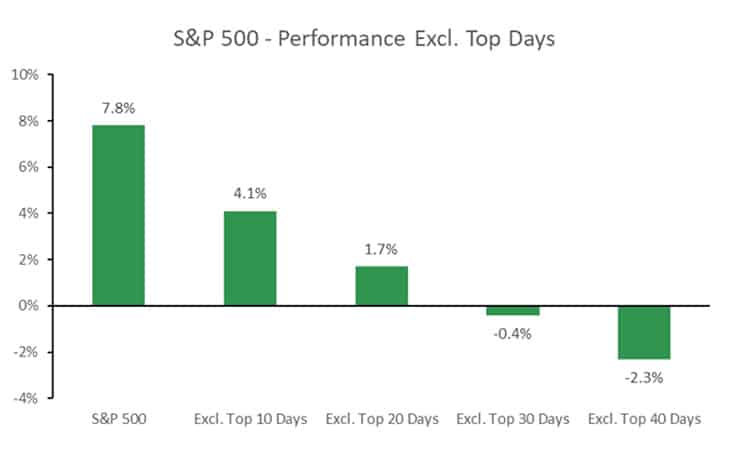

- You’ll miss the biggest gains if you try to time the market. Most of the gains the market makes each year come from only a few days; miss these days, and your returns will significantly diminish. If you keep your money in the S&P 500, the primary index for US equities, from 1996-2011, you will see an average annual return of 7.8%. However, if you miss the top 10 days per year because you mistimed trades or took yourself out of the market on those days, that growth quickly shrinks to 4.1%. Even worse, missing the top 30 days means you are losing money on average. Keeping money invested with a long-term plan and only liquidating for specific reasons helps ensure you do not miss any days when the market returns superior gains.

- Nobody can predict the future and get the timing right. Although it may seem simple to outperform the market by buying when it dips and selling when it hits a peak, it ignores the fact that the market moves almost randomly: nobody knows how the market will move month-to-month, week-to-week, day-to-day, or even minute-to-minute.

A perfectly timed trade may be possible once or twice, but replicating it continuously soon becomes impractical. You will quickly run into the issue of missing some of the market’s best-performing days, causing you to settle for subpar performance.

- Bear markets don’t last forever. Although many talking heads will always try to exaggerate the market’s movements, there has not yet been a bear market from which a bull market didn’t quickly grow. After the 2008 Financial Crisis, it took five years for the US equities market to blow past its previous high as the start of the longest bull market in history.

In Japan, the beginning of the Covid-19 pandemic caused investors to panic and sell off their investments. The Nikkei 225, Japan’s most significant market index, suddenly dropped by 35% within a few days, only to grow 6.5% from its original point within six months and 24% within a year.

Had investors hastily pulled their money out without a solid plan, they would lose out on the growth of the extensive bull run after 2008 or a net gain just after the Covid-19 pandemic market drop.

Let Us Help You Grow Your Wealth

Talk with us today!

- Sitting on cash is not always a good option, especially when you have a high inflationary environment. When the market becomes volatile, the natural reaction may be to pull out of your investments and keep your money in liquid cash. However, staying in cash comes with its risks. First up is inflation, which eats into the value of your money over time.

Historically, currencies like the US dollar saw inflation hover between 1-3%. While not sounding like much, the compound effects can be significant: an item costing $10 in 2000 would cost $15 in 2020. Inflation is an acute issue in 2022 when inflation all over the world is decades high, and even Japan is starting to see prices rise faster than we have seen in a long time.Another considerable risk of cash is currency risk. For example, if you are living in Japan in 2022 and holding the Japanese yen, you saw the value of your money drop significantly versus other currencies like the USD. This is a problem when traveling abroad and investing, as a weaker yen means you can’t buy as many foreign securities or assets with your cash.

- Staying in the market longer is cost-efficient. By not trading in and out of the markets constantly, you can save on trading costs and potentially benefit from preferential tax treatment.

In the United States, the government charges you a preferential tax rate for selling assets after holding them for a year or longer compared to less than a year. In Japan, investors who sell a property within five years of purchase are charged twice the tax rate (about 40%) on the gains of those sold after five years.Investing for the long run helps minimize the costs of trading, letting you keep more money in your pocket when you decide to sell. For an exaggerated example of how bad buying and selling can be cost-wise, please read our article on how Japan taxes cryptocurrencies.

- Trusting the time in the market process is less stressful. By sticking to a long-term financial plan, you no longer need to pay attention to what is happening in the market short term. Sudden drops and outsized gains are no longer a source of stress because they won’t affect your position in the long run.This makes investing much less daunting and scary, as you are no longer worried about the day-to-day performance of your portfolio. Keeping a long-term view will help you see market drawdowns as opportunities rather than reasons to panic. Also, remember that the longer your money is invested for, the greater the compounding growth effect will be.

As an investor, it is essential to remember that if you invest towards a longer-term goal, like retirement or purchasing a home, you must keep your emotions in check. This means not reacting emotionally during market drops. Acting on emotion when investing often leads to bad results, much like in other areas of life.

The case for timing the market

There are cases when you can use “timing the market” to your advantage. Here are three ways you can use timing to improve results on your investments.

- When there are significant market drops and overly negative market sentiment, we usually see it as a signal of a potential buying opportunity for clients with liquidity and sufficient time horizon. This does not happen often, but when it does, it generally pays off to take advantage.For example, the immediate shocks of the Asian Financial Crisis, the Dot-Com Bubble, Lehman Brothers’ bankruptcy, and the Covid-19 pandemic created sudden drops in the market that, if taken advantage of, could lead to sizable and stable gains.

However, timing the market in this way comes from titanic shifts in the market, not day-to-day fluctuations.

- One of the strategies we can use to benefit from timing the market is cost averaging. With cost averaging, we continually put money into investments, whether they are high or low.This lets us benefit from the market’s long-term growth while simultaneously taking advantage of drops when they happen. It is essentially the best of both worlds.

To learn more, please read our article on the benefits of cost averaging your investments.

- Your financial advisor may sometimes plan to buy or sell your investments when the market moves a certain way to rebalance your portfolio. This is because those assets were going to be traded anyway, so they might as well be sold at a short-term high and bought at a short-term low.In certain circumstances, this may also be done to harvest losses for tax purposes and is a common strategy for some US-specific investment accounts.

Although “time in the market” is generally superior to “timing the market”, everyone’s financial plan differs.

For some clients, the plan is to invest their assets and hold onto them for the long term, but for others, the plan may be to sell their investments when certain thresholds are met.

Investing with “time in the market” in mind is powerful, but it is always best to speak with a professional financial advisor who can help guide you with your unique long-term plan.

If you are considering investing but want to speak to an advisor, please get in touch with us today for a free consultation. Argentum is Japan’s premier financial planning and wealth management consultancy focusing on helping the foreigner community in Japan improve their financial well-being.

Argentum Wealth does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Argentum Wealth Management is licensed through the Japanese Financial Services Authority to give financial advice. The FSA strongly recommends that you only receive financial advice and services from a locally licensed and regulated firm.