Reluctant to invest in a volatile market? Why a regular savings plan, and dollar cost averaging, may be your answer.

Whether your financial dream is to have sufficient funds for your retirement, your child’s university education, or your dream wedding and house, take comfort knowing that a disciplined investing approach with a monthly savings plan can help you in a powerful way. A regular savings plan helps instill financial discipline as you are forced to save on a monthly basis.

The basic idea of investing well is simple: buy when the market is low and sell when it’s high. However, even the most sophisticated, experienced investors have a hard time trying to perform such a feat consistently.

This is because investment markets tend to be volatile – rising and falling suddenly for reasons which are often unexpected. It is this volatility, though, which also creates the potential for returns. By taking a disciplined approach to how you invest, you can make volatility work for you, ride out periods of poor performance, and achieve smoother returns over the long run.

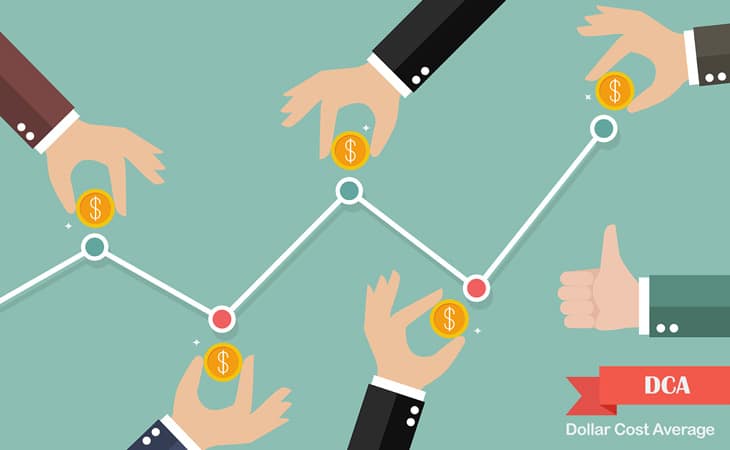

Instead of investing all your money at once, try a steady approach, investing a set amount over a set period. This way of investing is known as Dollar Cost-Averaging and is one of the fundamental features of regular savings plans. By using this method, you will be able to turn market volatility to your favor by harnessing the power of this simple, yet highly effective investing principle. This is just one of the savings plan benefits you can expect from investing monthly.

Get Started With Monthly Investing

We will help you put your money to work

How it works & Savings Plan Benefits

Cost Averaging refers to the practice of building investment positions by investing fixed dollar amounts at equal time intervals, as opposed to investing a lump sum all at one time. It can be especially helpful during lengthy bear markets because the market is down or flat for a more extended period of time.

One benefit of investing the same amount of money at each interval is that you’re buying more shares of whatever asset you’re buying when the price is low and fewer shares when the price is high. The dollar amount remains the same, but the share volume goes up and down with the market.

For example, investing in the S&P over the last 20 years produced an annualized return of 7.2%, but missing just the top 10 days in those 20 years cuts the return in half, to 3.5%. Investing on a regular monthly basis means investors aren’t missing out on those top 10 days if they get concerned during a downturn.

Dollar cost averaging also enables new or less experienced investors to get started with a relatively small amount of money.

You don’t have to wait until a large lump sum is available because you’re investing smaller set amounts of money into the fund or asset continually throughout the year. The strategy also means you’re continuing to invest toward your goal rather than stopping and starting repeatedly.

By staying invested, you are more likely to achieve your goals. And by staying invested for longer, you allow the power of compounding to grow your money over time. This strategy is particularly useful in a volatile market because you reduce the risk of accidentally investing all your money when prices are high. The key is to buy low, so by spreading out your investments throughout the year; you’re not investing everything right before the market falls.

Another benefit is that it can be an effective way for investors to mitigate one of the practical flaws of lump-sum investing – the mind’s tendency to make counter-productive decisions that are driven by loss aversion and volatility-induced emotions. It ensures that investors aren’t just responding to their emotions by selling high and buying low.

So, if you are thinking of making your money work for you and would like to learn more about regular savings plans, feel free to contact a financial advisor here at Argentum Wealth for a free consultation. We would be more than happy to help you take a disciplined and consistent approach to investing that will give you the ability to withstand periods of volatility and maximize your long-term wealth.

Argentum Wealth does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Argentum Wealth Management is licensed through the Japanese Financial Services Authority to give financial advice. The FSA strongly recommends that you only receive financial advice and services from a locally licensed and regulated firm.